[ad_1]

The NASDAQ 100 has carried out exceptionally nicely over the previous decade, pushed by the robust efficiency of expertise firms that make up a good portion of its holdings. The index is comprised of the highest 100 largest non-financial shares listed on the NASDAQ inventory trade.

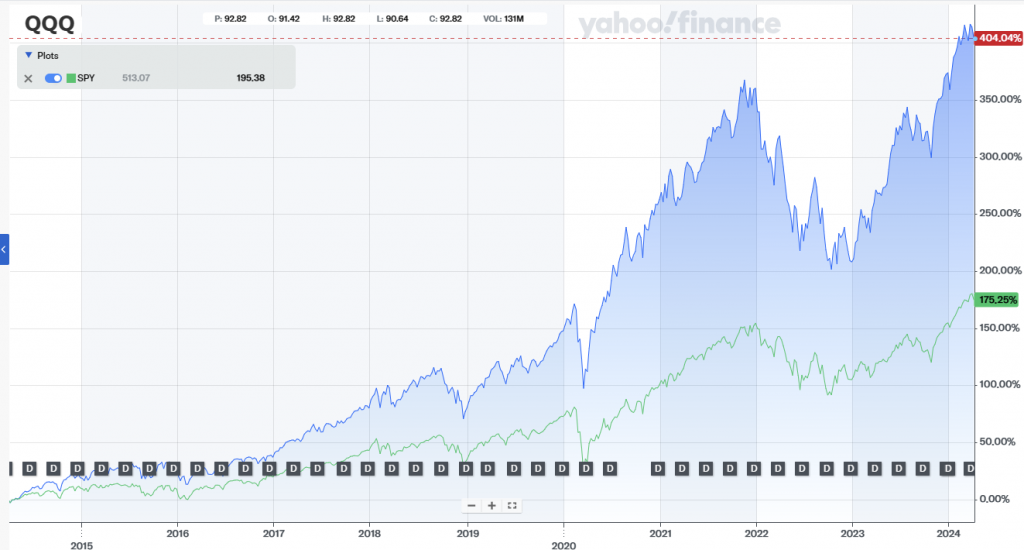

a 10-year chart of the NASDAQ 100’s efficiency in opposition to the S&P 500 is all it is advisable do to know simply how nicely it has carried out. And that is over a interval the place the S&P 500 has outperformed nearly all the things else.

With a run like this, you may assume that there wouldn’t be many shares that might cross basic methods like these we run at Validea.

And you’ll be appropriate.

However that doesn’t imply there aren’t any.

Listed here are 5 shares that rating extremely primarily based on the basic investing fashions utilized by Validea, that are primarily based on the methods of legendary buyers.

Prime NASDAQ 100 Shares In keeping with Validea’s Fashions

Lululemon is a retailer of athletic attire, recognized for its yoga-inspired clothes. The inventory scores an ideal 100% on Validea’s Warren Buffett-based “Affected person Investor” technique. This mannequin appears to be like for firms with predictable, constant earnings progress, which Lululemon has demonstrated with earnings per share growing in 8 of the previous 10 years. The corporate additionally boasts a excessive common return on fairness of 27.6% over the previous decade, indicating a robust aggressive benefit. Moreover, Lululemon has no long-term debt, a optimistic for the conservative Buffett method. The inventory additionally scores nicely on the Peter Lynch-based technique, because of its cheap P/E-to-Development ratio of 0.97.

Utilized Supplies is a number one provider of semiconductor manufacturing gear. Like Lululemon, it scores an ideal 100% on the Buffett-based method. The corporate has grown earnings constantly, with EPS growing in 9 of the previous 10 years. It additionally has a excessive common return on fairness of 35.3% over the previous decade. Utilized Supplies’ debt can also be manageable, with earnings able to paying off all debt in lower than two years. The inventory additionally will get a 94% rating from the “Twin Momentum Investor” mannequin, which appears to be like for firms with robust worth and earnings momentum.

Google’s father or mother firm Alphabet is a prime choose for a number of of Validea’s methods. It will get an ideal rating from the Buffett mannequin, with constant earnings progress, excessive returns on fairness (18.2% 10-year common), and cheap debt ranges (earnings might repay all debt in below two years). Alphabet additionally scores an 88% from the “P/B Development Investor” mannequin, which favors progress firms buying and selling which have excessive and constant returns on property and powerful funding sooner or later through capital expenditures and analysis and improvement.

Retailer Costco is one other favourite of Validea’s fashions. It earns an ideal rating from the James O’Shaughnessy-based “Development/Worth Investor” mannequin, which appears to be like for firms with persistent earnings progress, robust relative energy, and cheap Worth/Gross sales ratios. Costco has grown earnings in every of the previous 5 years, has a relative energy of 84, and trades at a Worth/Gross sales ratio of 1.31, passing all the important thing assessments of this technique. The inventory additionally will get an 80% rating from the “Worth/Gross sales Investor” method primarily based on Kenneth Fisher’s technique, because of its cheap Worth/Gross sales ratio and low debt ranges.

Tech big Apple is a prime choose for a number of Validea fashions. It scores an ideal 100% on the Buffett-based method. The corporate has grown earnings constantly (EPS up in 8 of previous 10 years), generates excessive returns on fairness (83.6% 10-year common), and produces substantial free money movement ($5.35 per share). These components point out a robust aggressive benefit and shareholder-friendly administration. Apple additionally will get an 87% rating from the Peter Lynch-based technique, which focuses on the P/E-to-Development ratio (at 1.31, Apple’s PEG is taken into account acceptable below this mannequin).

Regardless of the NASDAQ 100’s large run, these 5 shares all earn excessive marks from Validea’s guru-based inventory screening fashions. Every affords engaging fundamentals, together with robust earnings, excessive returns on capital, and strong stability sheets. For these on the lookout for essentially engaging shares amongst NASDAQ 100 names, these 5 shares may very well be an ideal place to begin.

Analysis Hyperlinks

[ad_2]