[ad_1]

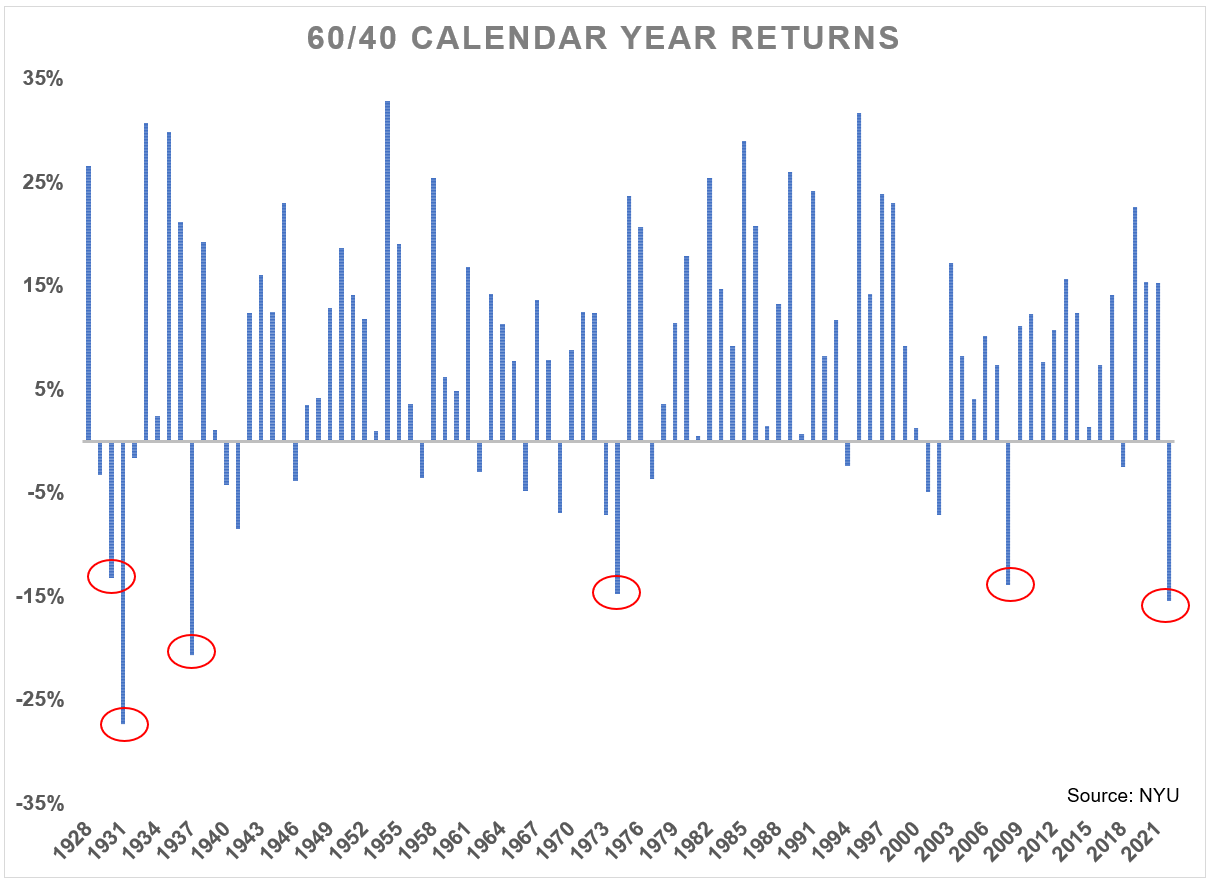

A 60/40 portfolio of U.S. shares and U.S. bonds has solely completed the yr down double digits simply 5 instances prior to now 94 years by year-end 2021.1

With shares and bonds each down round 15% every in 2022 up to now, it seems this yr would be the sixth time in 95 years:

If we completed the yr the place issues stand as of at present, it might be the third worst yr for a 60/40 portfolio in virtually 100 years.

The one years it was down greater than this occurred within the Nineteen Thirties. In 1931, a 60/40 portfolio was down 27.3%. Then in 1937, a diversified portfolio fell 20.7%.

“There’s nowhere to cover” is a typical chorus this yr.

I’ve all the time been of the mindset that long-term returns are the one ones that matter. Something can occur within the short-term. Diversification solely works for affected person individuals.

It’s additionally comprehensible why many buyers are pissed off with this yr’s efficiency, particularly retirees.

It may be scary in the event you expertise unhealthy returns on the fallacious time.

The Wall Road Journal had a narrative this week that detailed the struggles of a 60/40 portfolio this yr and the way it’s impacting buyers who retired in recent times:

Eileen Pollock, a 70-year-old retiree dwelling in Baltimore, has seen the worth of her portfolio, with a roughly 60-40 combine, dip by tons of of hundreds of {dollars}. The previous authorized secretary had amassed greater than 1,000,000 {dollars} in her retirement accounts. To construct her financial savings, she left New York to dwell in a cheaper metropolis and skipped holidays for a few years.

“1,000,000 {dollars} looks like quite a lot of cash, however I noticed it’s not,” she stated. “I noticed my cash was piece by giant piece disappearing.”

This yr has been horrible for a diversified mixture of shares and bonds but when we zoom out, the returns coming into this yr had been lights out for a 60/40 portfolio.

Within the 3, 5 and 10 years ending in 2021, a 60/40 portfolio of U.S. shares and bonds was up 63%, 81% and 184%, respectively.2

Even when we embody this yr’s 15% or so loss within the 60/40, the previous 10 years has given buyers 8% per yr on this technique.

The nice has far outweighed the unhealthy, which is normally the way it works within the monetary markets.

The unhealthy years aren’t any enjoyable however the good many years are inclined to greater than make up for it.

Shedding a big chunk of your life financial savings isn’t time however buyers want to appreciate their portfolio values wouldn’t be so excessive within the first place if it wasn’t for the bull market that led as much as these tough instances.

It’s additionally true that you could’t financial institution on funding returns carrying all the load in your monetary plan. Typically the markets merely don’t cooperate.

And the monetary markets can solely take you up to now.

The Journal outlined a research that reveals many retirees have to chop their lifestyle in retirement as a result of they didn’t save sufficient:

Roughly 51% of retirees reside on lower than half of their preretirement annual earnings, in keeping with Goldman Sachs Asset Administration, which this summer time performed a survey of retired Individuals between the ages of fifty and 75. Practically half of respondents retired early due to causes outdoors their management, together with poor well being, dropping their jobs and needing to care for members of the family. Solely 7% of survey respondents stated they left the workforce as a result of they’d managed to save lots of up sufficient cash for retirement.

Most Individuals stated they would favor to depend on assured sources of earnings, like Social Safety, to fund their retirement—not returns from risky markets. However solely 55% of retirees are ready to take action, the agency discovered.

It doesn’t matter how excessive or low your funding returns are in the event you don’t save sufficient within the first place.

It might be significantly better if we lived in a world the place extra individuals had a pension or simpler entry to common earnings streams in retirement.

Sadly, most of us are caught coping with the monetary markets, volatility and all, to enhance our lifestyle over the lengthy haul.

However the necessary factor to recollect is it doesn’t matter the way you make investments your cash in the event you don’t save sufficient within the first place.

The monetary markets can’t prevent in the event you don’t save.

Additional Studying:

The Worst Years Ever For a 60/40 Portfolio

1As common, I’m utilizing the S&P 500 for shares and 10 yr treasuries for bonds. Knowledge supply right here.

2I’m fairly certain nobody truly has a portfolio of 60% U.S. shares and 40% U.S. bonds however oh properly.

[ad_2]