[ad_1]

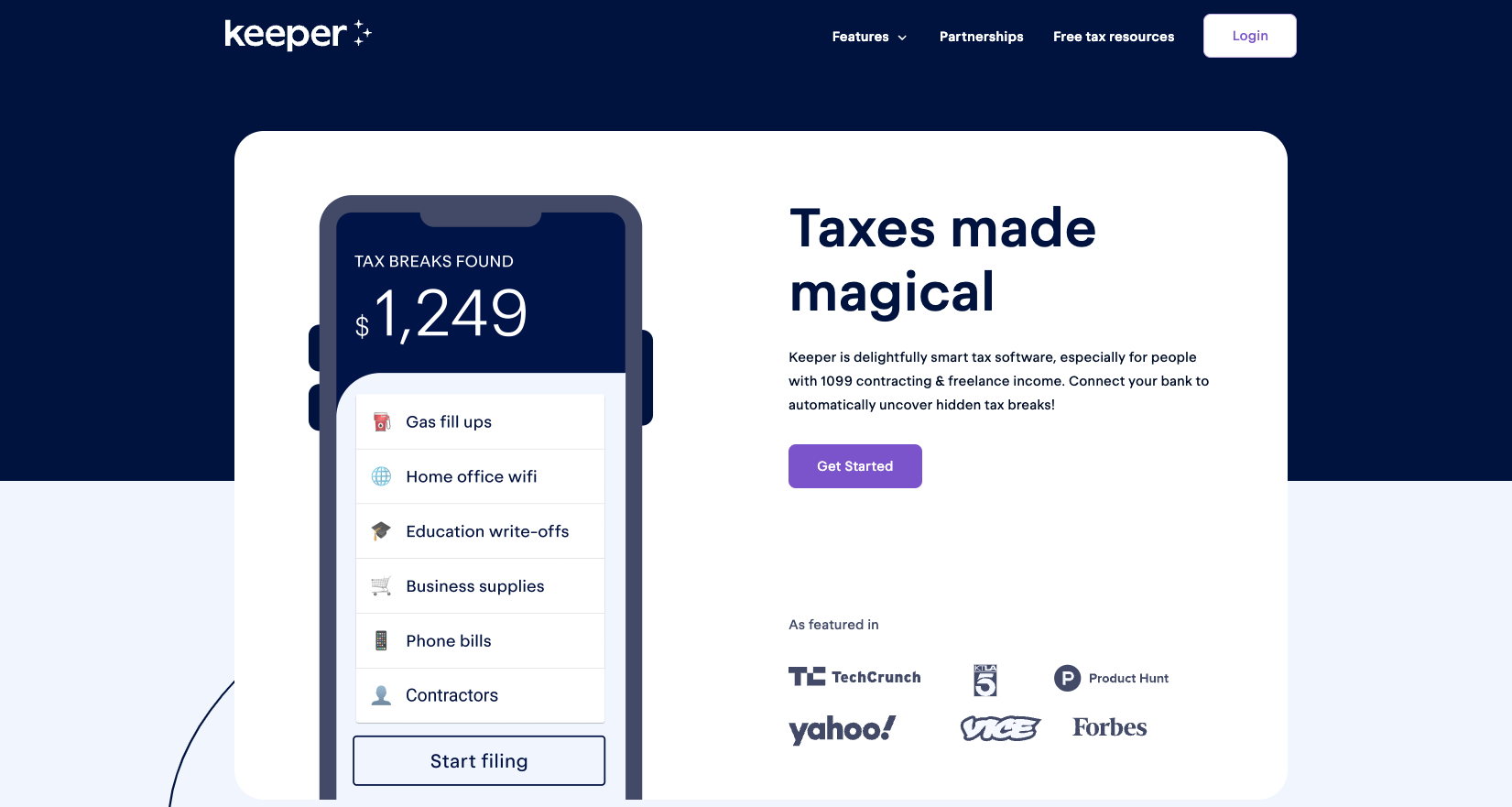

Keeper is an app that helps impartial contractors, freelancers, and staff file their tax returns whereas preserving observe of work-related bills.

The app is offered for each iOS and Android units, or you should utilize a web-based desktop model.

Keeper might be a superb match if you wish to keep organized come tax time. It’s necessary to contemplate pricing and options earlier than signing up. Right here’s a better have a look at Keeper Tax and what you might want to know in the event you’re searching for an app to trace bills and file taxes.

See how Keeper compares with our checklist of one of the best tax software program right here.

|

Month-to-month Subscription (Does Not Embody Tax Submitting) |

|

|

Annual Subscription (Contains Tax Submitting) |

|

What Is Keeper?

Keeper, previously known as Keeper Tax, is an app designed for expense monitoring and tax submitting for impartial contractors and small enterprise house owners. Keeper can scan your financial institution and bank card statements to search for bills to trace and write off, aiming to decrease your tax invoice. It additionally handles your tax submitting and presents tax professionals to offer solutions to questions associated to submitting.

The corporate, based in 2018 by Paul Koullick and David Kang, has rebranded from Keeper Tax to Keeper. The app is extremely rated on each the App Retailer (4.8 out of 5) and Google Play (4.5 out of 5).

How Does Keeper Work?

Keeper is a mobile-first app that works on-line and in your cellphone. Customers hyperlink financial institution and bank card accounts to the app to mechanically scan purchases to search for potential write-offs.

After signing up with Keeper, you will be requested a collection of questions earlier than you possibly can transfer on to the following display screen. For instance, it asks in the event you’re a freelancer, an worker, or a enterprise proprietor. It additionally asks in the event you use your automobile or journey for work.

How A lot Does Keeper Price?

There’s a free seven-day trial with Keeper. As soon as that ends, listed below are your pricing choices:

- Month-to-month subscription (expense monitoring solely): $20

- Annual subscription (expense monitoring and taxes): $192

The month-to-month plan is $20 per thirty days, which incorporates the expense-tracking options solely. Keeper presents a yearly plan, which incorporates every thing on the month-to-month plan, plus the choice to file your taxes at no extra value.

Notable Keeper Options

Let’s check out some key options from Keeper.

Tax Professional Assist

If you use a platform that can assist you file your taxes, it’s possible you’ll not have entry to a stay skilled. Or, in the event you do, you’re required to improve to a better tier. The great factor about Keeper is that you’ve entry to a tax skilled who can reply questions for you. It is probably not over the cellphone, however no less than you possibly can have somebody enable you together with your particular situation.

Keeper prides itself on being a prime instructional content material producer for these with 1099 taxes, so they might additionally have the ability to serve you with a video, article, or give you a calculator.

Audit Safety

Past an skilled to reply your questions, it’s possible you’ll wish to know what would occur in the event you have been to be audited by the IRS. Keeper supplies audit safety, which suggests their group of tax assistants will assist collect any essential paperwork to ship to the IRS in the event you’re topic of an audit. They may even give you entry to CPAs and tax specialists who can reply any questions.

Write-Off Detection

Keeper presents write-off detection, which scans your bank card and financial institution accounts and notifies you of bills you possibly can write off. Keeper appears at as much as 18 months of transactions to mechanically present which tax breaks might have been missed. Then, the entire deductions are categorized and mechanically added to your tax return. Keeper additionally double-checks the deductions to verify they received’t increase crimson flags with the IRS.

Just a few steps are concerned earlier than you should utilize this characteristic, together with letting Keeper know what sort of work you do. Then you might want to hyperlink your accounts to Keeper so it may well scan your transactions.

Tax Invoice Prediction

Nobody likes feeling shocked by a large tax invoice, which is why Keeper provides you year-round estimates on how a lot you’ll doubtless owe or lets you understand how a lot your refund will probably be.

You need to enter your standing, state, W-2, and 1099 revenue to calculate this quantity immediately. Their calculations embody all federal and state taxes, together with deductions and credit.

This can be a useful characteristic as a result of you understand how a lot to save lots of or how a lot you’re getting again, so you possibly can price range for taxes forward of time.

Tax Submitting

Since Keeper already scans your tax write-offs and will get you prepared for tax season, submitting your taxes with Keeper might make sense. It presents computerized tax type uploads and pre-fills paperwork for you. Usually, it’s a really user-friendly expertise for filers.

You possibly can file your complete taxes utilizing your smartphone. Keeper says, on common, it takes customers 22 minutes to file their taxes. When you submit, a tax skilled critiques your paperwork earlier than submitting to the IRS.

How Does Keeper Examine?

Though Keeper is an easy-to-use platform that helps you with bookkeeping and submitting, it has restricted accounting options. It’s a must to pay $192 for the yr to handle your bills however haven’t any entry the in-depth studies and options you get with QuickBooks, Xero, or different bookkeeping apps. It’s additionally on the pricier facet, at $20 a month for expense monitoring solely.

For a less expensive choice, you could possibly take a look at Hurdlr, which is an identical accounting, bookkeeping, and revenue taxes app that’s completely free with the choice to improve to Premium at $8.34 per thirty days (billed yearly) or select to go together with their month-to-month choice at $10 a month. Hurdlr has a similarly-priced tier, Professional, at $16.67 per thirty days (billed yearly).

Everlance helps freelancers observe their enterprise bills and revenues. The app makes filling out a Schedule C to your taxes straightforward. Everlance presents a free 10-day Premium trial, however lots of the options can be found of their free model. Everlance Premium options particular customer support entry, PDF studies, and computerized journey monitoring. Premium prices $8 per thirty days or $12 per thirty days for Premium Plus.

|

Header |

|

|

|

|---|---|---|---|

|

|

|

|

|

Cell |

In case your taxes aren’t that sophisticated, you could possibly file utterly without spending a dime. Try our favourite choices to file your taxes without spending a dime.

Loads of different inexpensive choices can help you export your knowledge and not using a $39 added value. TurboTax tops The School Investor’s checklist as one of the best and best tax software program to make use of (although it’s additionally a bit costly). You possibly can import PDFs and spreadsheets instantly out of your employer, monetary establishments, and funding corporations to obtain your tax knowledge.

If you’d like a human to assist information you thru the method, take into account H&R Block, which has sturdy software program with the flexibility to import most tax PDFs, like Turbotax, but in addition has the additional advantage of 1000’s of bodily areas throughout the nation. Right here’s our evaluate of H&R Block.

Go to The School Investor’s Tax Heart to be taught extra about one of the best tax software program, assets, and instruments, plus what to grasp about your tax return.

To contact customer support, you possibly can e-mail help@keepertax.com. There isn’t any cellphone quantity for customer support.

How To Signal Up

You’re requested for an e-mail deal with and a cellphone quantity. Then, you’re given an choice of whether or not you wish to hyperlink your checking or bank card accounts to seek out eligible write-offs in the event you freelance, for instance.

After answering the questions and inputting your e-mail deal with, you’re requested to obtain the app via a QR code in your pc, or you possibly can go on to the App Retailer or Google Play to obtain the app.

Free Tax Sources And Buyer Service

Keeper is large on educating you on what to find out about your taxes that can assist you lower your expenses and scale back your taxable revenue. They do that via their Free Tax Sources web page, which homes data articles, free calculators, instruments, articles, and FAQs on their web site.

For extra particular solutions to clients’ questions, go to their assist web site.

Why Ought to You Belief Us?

The School Investor group spent years reviewing the entire prime tax submitting choices, and our group has private expertise with the vast majority of tax software program instruments. I personally have been the lead tax software program reviewer since 2022, and have in contrast a lot of the main corporations on {the marketplace}.

Our editor-in-chief Robert Farrington has been making an attempt and testing tax software program instruments since 2011, and has examined and tried virtually each tax submitting product. Moreover, our group has created critiques and video walk-throughs of the entire main tax preparation corporations which yow will discover on our YouTube channel.

We’re tax DIYers and need a whole lot, identical to you. We work arduous to supply knowledgeable and sincere opinions on each product we take a look at.

Is Keeper Really A Keeper?

Keeper is a powerful expense monitoring plus tax submitting combo. In case you freelance, have 1099 revenue, and your funds are comparatively simple (i.e., you file a Schedule C), it’s possible you’ll recognize the app. Keeper is simple to make use of, and the expense-tracking options could also be worthy of the $20 month-to-month payment for some people.

Nevertheless, when you have a extra sophisticated work, revenue, and monetary scenario—for instance, in the event you personal rental actual property or purchase and promote crypto often, it’s possible you’ll take into account a extra sturdy software program like TurboTax or H&R Block paired with an sufficient bookkeeping software program suite.

Keeper Options

|

|

|

Month-to-month Subscription Price (Expense Monitoring Solely) |

|

|

Annual Subscription Price (Contains Tax Submitting) |

|

|

Ask A Tax Knowledgeable (Free service from Keeper) |

|

[ad_2]