[ad_1]

Quick-term rates of interest proceed to cost larger because the economic system stays stronger than anticipated.

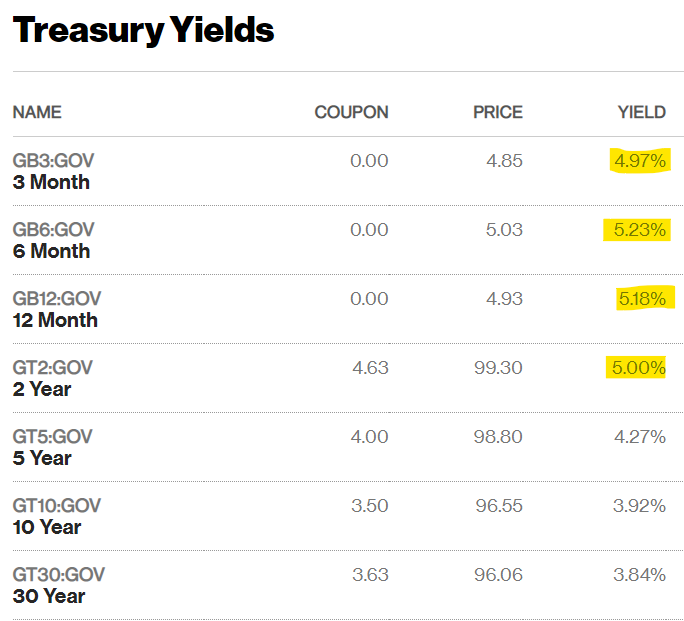

We’re taking a look at 5% yields throughout the board for short-term authorities bonds.

Some folks will nonetheless scoff at these yields by reminding you that inflation continues to be 6% however let’s be trustworthy — proper or mistaken, most buyers suppose in nominal phrases, not actual.

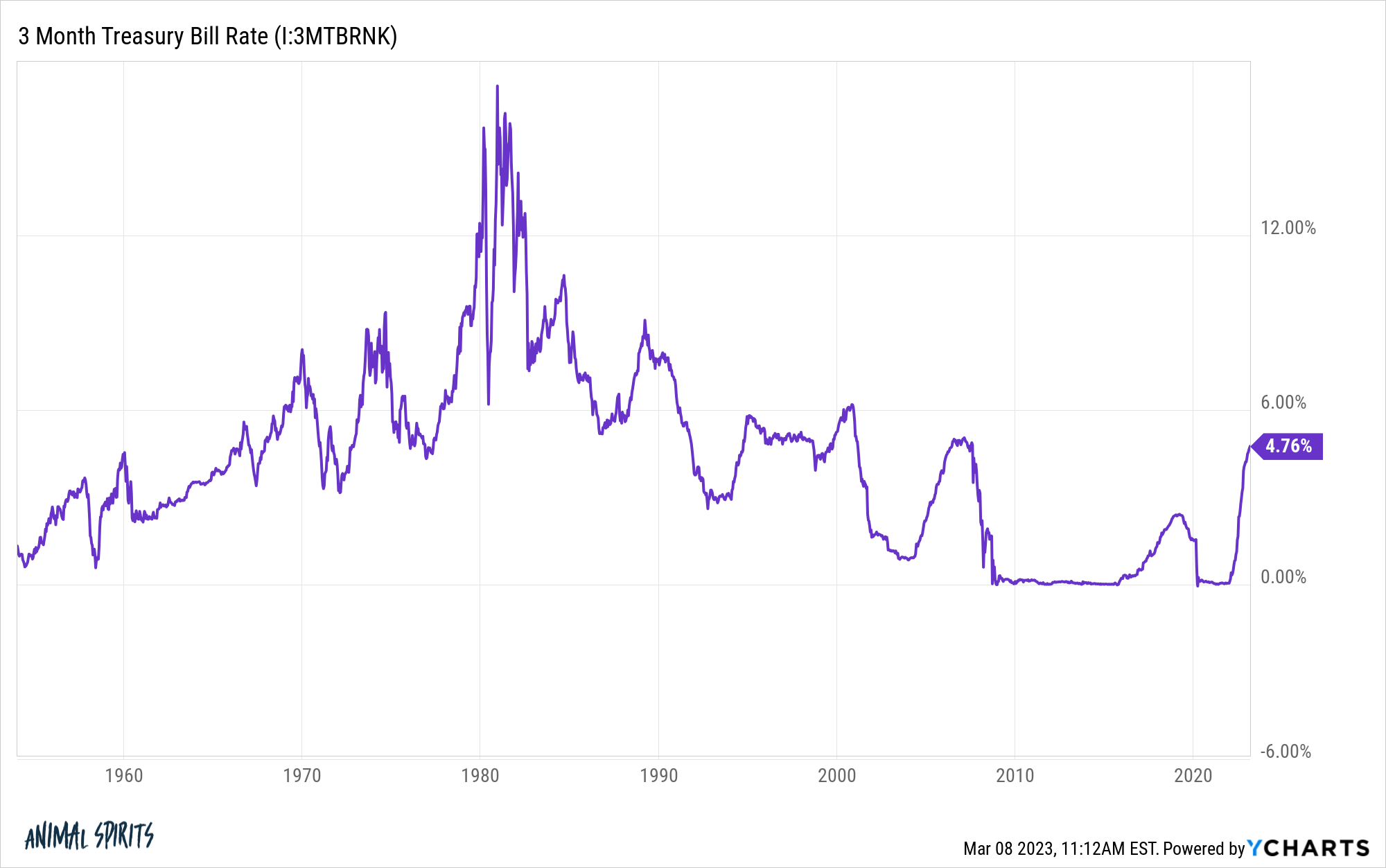

Quick-term yields have been on the ground for thus lengthy that 5% rates of interest are sure to seize the eye of buyers.

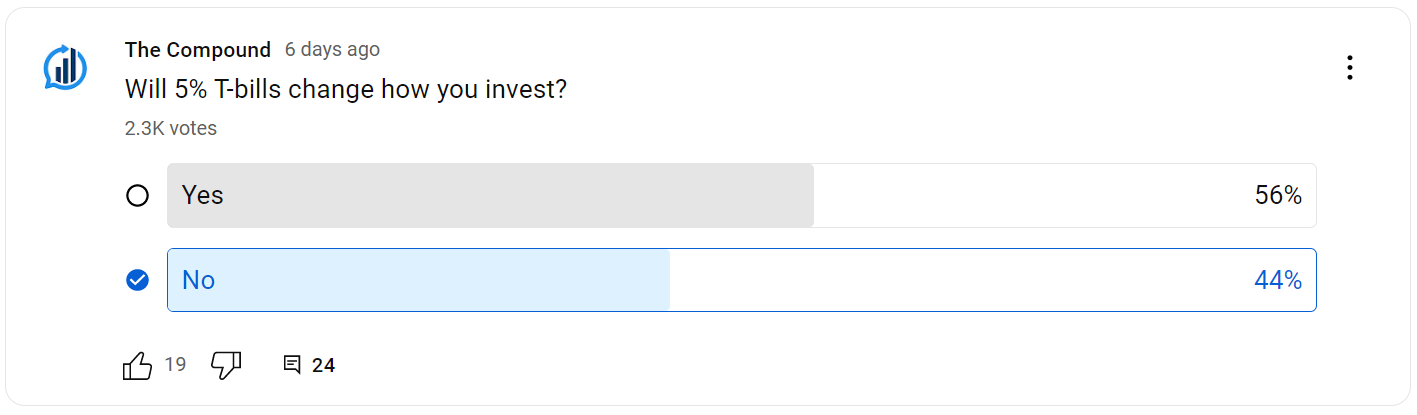

We requested our YouTube viewers if 5% T-bills will change how they make investments:

Greater than half of the respondents mentioned this new world the place comparatively protected yields exist would change how they make investments.

For a couple of years there charges had been so low many buyers had been being compelled out on the danger curve. I do know loads of balanced buyers who most well-liked a 60/40 portfolio however opted for a 70/30 or 80/20 combine as a result of bond yields had been so pitiful.

The excellent news about 5% bond yields is that extra conservative buyers not need to stretch anymore.

Your anticipated returns are clearly significantly better when yields are at 5% than when they’re at 1% or much less.

Your asset allocation can change for any variety of causes.

Your monetary circumstances or targets may change. Your willingness, want or capability to take threat may change. The markets may change.

However there is a crucial distinction between an asset allocation resolution primarily based on threat vs. reward trade-offs and market timing.

The largest downside with making an enormous shift in your portfolio from shares to money is that short-term rates of interest are fickle.

They’ll go up shortly but additionally drop in a rush.

Quick-term bond yields may keep elevated for some time if the economic system and inflation stay robust and the Fed battles excessive inflation.

However what occurs if/when short-term charges return down? If the Fed retains elevating charges finally that’s going to sluggish issues down.

When inflation slows and the economic system weakens the Fed goes to chop charges. Sadly, T-bill yields received’t be 5% if inflation is 3%. At present’s 5% yields aren’t going to final without end.

I don’t know what’s going to occur within the short-term in terms of rates of interest or the inventory market. Nobody does (not even the Fed). I choose to make funding selections primarily based on my threat profile and time horizon moderately than attempt to make forecasts about what’s going to occur subsequent.

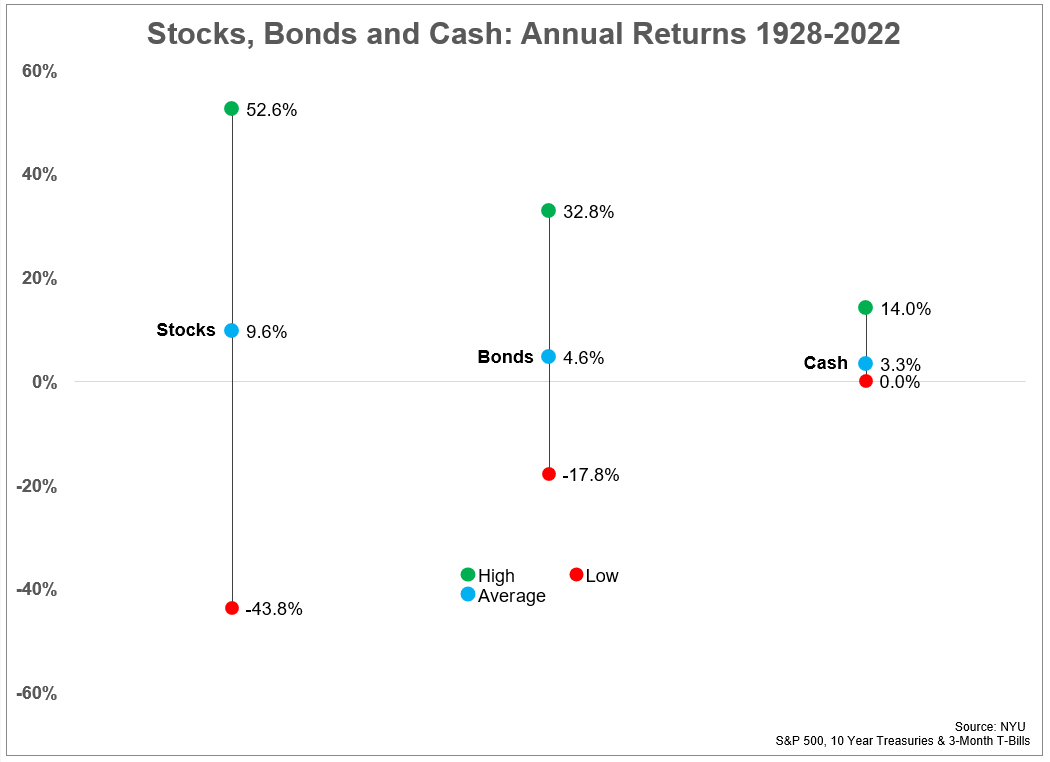

Within the short-run money can provide stability. In the intervening time it additionally provides fairly, fairly good nominal yields. Over the long-run you’ll barely sustain with inflation.

Within the short-run shares can rip your coronary heart out. I don’t know if the bear market is over or if we’re in for extra carnage. However over the long-run the inventory market stays one of the best guess for beating inflation and compounding your wealth.

Market timing requires you to be proper twice.

Getting out is straightforward. Getting again shouldn’t be.

One of the best case can be you progress some or your entire portfolio into money, the inventory market drops, you clip your 5% and miss out on some losses, then shift again to shares when yields fall.

The worst case is you progress some or your entire portfolio into money, yields fall, the inventory market rips, you miss out on the positive factors and now you’re caught in an asset class with low anticipated returns.

Don’t get me mistaken — I like the concept of benefiting from 5% yields. In case your cash is sitting in a checking account incomes nothing you’re lacking out. And stuck revenue buyers have higher yield choices than they’ve had in years.

I’m not attempting to speak anybody into or out of any asset class.

Money has a spot in a portfolio for short-term liquidity wants and stability.

Bonds have a spot in a portfolio to offer revenue and safety in opposition to deflation and disinflation.

Shares have a spot in a portfolio to offer larger anticipated returns and safety in opposition to the long-term impacts of inflation.

I simply suppose it’s troublesome to always shift your asset allocation into and out of those asset lessons with out inflicting some hurt to your funding plan.

Asset allocation is for affected person folks.

Additional Studying:

A Quick Historical past of Curiosity Fee Cycles

[ad_2]