[ad_1]

By Jack Forehand, CFA, CFP® (@practicalquant) —

There are some core ideas which can be supposed to control investing. If I have been to ask you to provide you with an important a type of ideas off the highest of your head, there’s a fairly good likelihood you’d inform me that to get a greater return it is advisable to take extra danger. And in my expertise, that precept is an excellent one and does maintain nearly all of the time.

However there’s one key space of issue investing the place it doesn’t. That outlier is the low volatility issue.

One would anticipate that purchasing much less unstable shares would result in a decrease return. However the analysis may be very compelling that it doesn’t. Whereas it’s uncommon for there to be any free lunches in investing, low volatility does look like one among them.

Earlier than we get into why that’s, it’s in all probability finest to first outline what the issue is.

What’s Low Volatility?

Defining low volatility might be the simplest of all of the components we observe. Worth might be difficult to outline as a result of there are a whole lot of worth metrics. High quality is even worse and everybody appears to have a special definition for it. However low volatility is nearly shopping for shares which can be the least unstable. There are two main metrics which can be usually used. The primary is customary deviation, which measures the standalone volatility of any asset. The second is beta, which takes into consideration how the asset strikes relative to the market along with its personal volatility.

By the best way, one factor to bear in mind once you have a look at funding methods on this space is that there’s a important distinction between low volatility and minimal volatility. Low volatility focuses on the volatility of the person belongings you’re buying. Minimal volatility is a portfolio degree idea that focuses on maintaining the volatility of the general portfolio low. There’s definitely some overlap between the ideas, however you will need to remember that they’re various things once you see funds and ETFs that deploy the 2 methods.

Does Low Volatility Work?

I feel the clear reply this this query primarily based on the educational analysis is sure.

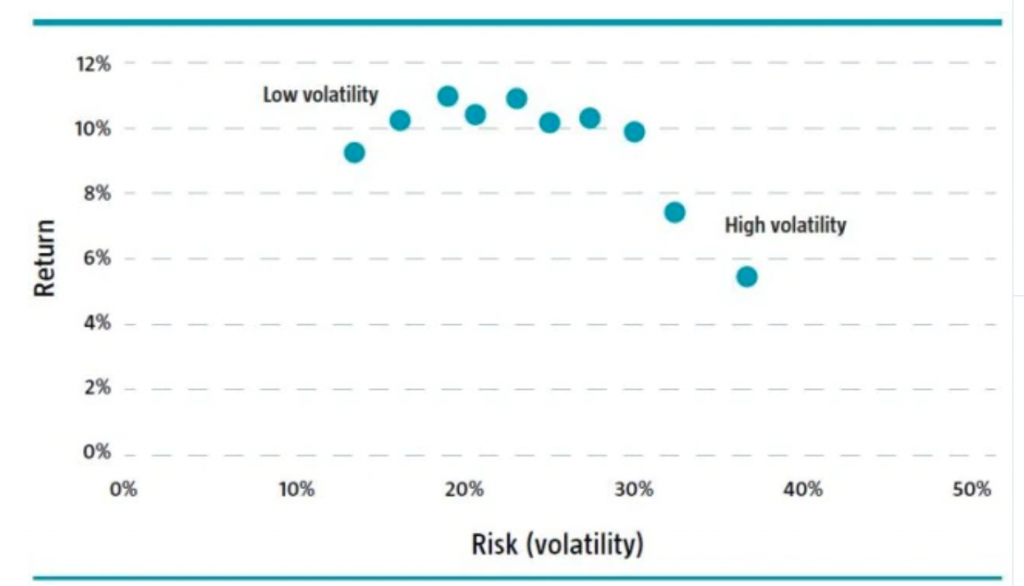

This chart from Robeco does a wonderful job of displaying the connection between return and volatility. You’d anticipate that as volatility will increase, return would too, however that isn’t what the information reveals.

https://www.robeco.com/au/key-strengths/quant-investing/glossary/low-volatility-factor.html

We have been in a position to interview Robeco’s Pim van Vliet, who is among the world’s main consultants in low volatility, for our podcast Extra Returns. If you wish to dig deeper into low volatility, I extremely advocate you test it out as Pim can clarify these ideas significantly better than I can.

Why Does Low Volatility Work?

Components usually work for 2 completely different causes. Both they produce an extra return by taking up extra danger or they capitalize on the habits of different traders that results in a mispricing. With low volatility, utilizing the risk-based framework doesn’t result in very satisfying outcomes since by definition the issue is choosing decrease danger shares. Low volatility is definitely susceptible to intervals of underperformance similar to the opposite components, however utilizing a normal danger framework, it’s tough to elucidate why the issue works.

That leaves us with the behavioral primarily based clarification. However that may be difficult with low volatility as effectively. With worth and momentum, the behavioral explanations are extra intuitive, however on this case, it’s a must to dig a little bit bit deeper to provide you with one. The most effective clarification I’ve heard is that traders who can not use leverage want a mechanism to spice up their returns. Because of this, they search out greater volatility shares as a method to do this and thus create a scenario the place they’re overpriced relative to their low volatility counterparts. This creates a relative alternative.

Low Volatility and Different Components

Even in case you are skeptical about low volatility, the excellent news is that it doesn’t have to be used by itself to be efficient. In truth, analysis has proven that utilizing low volatility with different components enhances its long-term return with no main influence on its danger lowering advantages.

Robeco and different researchers have discovered that each worth and momentum can improve a low volatility technique. In Pim van Vliet’s paper “Enhancing a low-volatility technique is especially useful when generic low volatility is dear”, he discovered that when low volatility is reasonable, it outperforms the market by 2.2% per yr, however when it’s costly, it underperforms by 1.4% (though it nonetheless outperformed on a risk-adjusted foundation). In his paper “The Conservative Formulation: Quantitative Investing made Simple”, he additionally discovered that coupling low volatility with worth momentum and excessive web payout yields produces enhanced returns. The components produced a 15.1% annualized return since 1929, which was effectively in extra of the market return.

Challenges to Low Volatility

The most important problem I’ve seen to low volatility shouldn’t be that it doesn’t work, however relatively that its success might be defined by different components. For instance, Larry Swedroe has talked about how nearly all of the surplus returns from low volatility comes from when the shares are low cost. Or in different phrases, a whole lot of low volatility’s success might be defined by intervals the place low volatility shares have been additionally worth shares.

And in case you couple worth with profitability or high quality, the end result will get much more compelling, as some analysis has proven that mixture explains successfully all of the returns of low volatility.

Larry wrote an glorious article the place you will discover extra particulars on these arguments.

The Issue That Shouldn’t Work

There are numerous skeptics about low volatility as a result of the logic behind it appears to problem the core investing perception that growing returns ought to require taking up extra danger. I can perceive these arguments as a result of I’ve been one among these skeptics myself. However in the long run, there’s robust proof to help the issue. The proof could not rise to the extent of the proof supporting worth or momentum, however it’s nonetheless laborious to refute. Even when the chance of low volatility doesn’t present up in customary danger metrics, although, it nonetheless exists and the issue can undergo prolonged intervals the place it doesn’t work similar to all the opposite components. However for traders who need to give attention to lowering volatility of their portfolio, the issue is definitely worthy of consideration.

Jack Forehand is Co-Founder and President at Validea Capital. He’s additionally a companion at Validea.com and co-authored “The Guru Investor: Find out how to Beat the Market Utilizing Historical past’s Greatest Funding Methods”. Jack holds the Chartered Monetary Analyst designation from the CFA Institute. Comply with him on Twitter at @practicalquant.

[ad_2]